About to make a big purchase at Target but wondering what your payment options are? Maybe you just downloaded Afterpay for the first time, and you’re excited to start shopping. No matter how you ended up here, we’re ready to answer all of your questions about using Afterpay at Target.

As one of the most popular retailers in the country, Target is a frequent choice for Afterpay shoppers, so we’re here to give you all the details on whether Target accepts this service in the USA. We’ll cover the drawbacks, advantages, limits, restrictions, and more, so keep reading!

Contents

What Exactly is Afterpay?

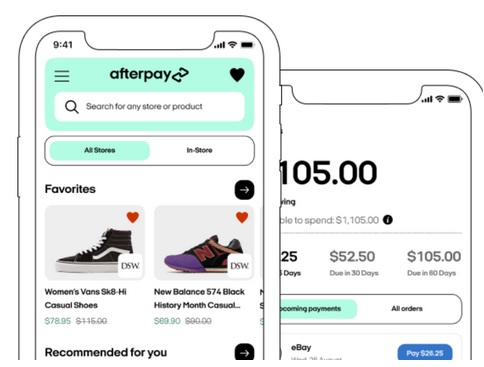

You might be wondering… what is Afterpay anyway? Afterpay is a “buy now, pay later” digital payment method designed to enable you to purchase the items you want without having to pay in full upfront.

When you make a purchase through the app (which you can set up on your phone and/or connect to your Apple Pay or Google Pay accounts), the total amount of your purchase is broken up into four even installments, which you are responsible to pay on time every two weeks.

The first payment (25% of the total purchase cost) is due at the time of purchase. Afterpay is completely free to use as long as you make all of your payments on time.

Does Target Accept Afterpay?

First, we’ll give you the good news: Yes! Target accepts Afterpay in the USA. Simply select it as your payment method of choice when shopping on Target.com or inside the Target mobile app. Keep reading to find out exactly how it works.

Now, the not-so-good news… Unfortunately, Target no longer accepts Afterpay as a valid form of payment in-store in the United States. It’s unclear why Target stores transitioned away from accepting this form of payment in-store, but we can confirm that it’s no longer an option. You can read more about the wide range of in-store and online payment options at Target here.

Does Target place limits or restrictions on purchases?

There are a ton of pros to using Afterpay, which we’ll get into later, but one of the few drawbacks is that retailers often place limits on how much you can spend via “buy now, pay later” payment methods. For Afterpay, Target places a $1 minimum and a $1000 maximum on purchases. You’ll obviously have no problem reaching the minimum, but you’ll want to be careful not to exceed the maximum when you’re adding things to your Target shopping cart online.

According to the company’s US Terms of Service, you also have to be at least 18 years old, a legal resident of the US, and be eligible to own a debit card to use the service, whether you’re shopping at Target or any other retailers. But as far as we can tell, there are no other restrictions to using this flexible payment method on Target.com or the Target app, so shop on!

How do I use this service to shop at Target?

Shopping on Target.com or in the Target app with your digital wallet is simple. Here are some easy steps to follow:

- Sign up for your Afterpay account – Before you do anything else, you’ll need to make sure that you have an active account. Simply visit the Afterpay US website or download the app onto your phone to sign up.

- Start shopping! – Once your account is set up, you’re ready to go. Simply visit Target.com or open up the Target mobile app and start filling up your cart. Just remember not to let your total exceed $1000.

- Select Afterpay at checkout – Just like with any other digital payment method, Afterpay will show up as one of your payment options when you start the checkout process with Target. If you don’t see it on the list or if you’re not able to select it as an option, make sure your order total is within the minimum-maximum range.

- Complete your purchase and begin making payments – When you make your purchase from Target with Afterpay, you’ll be charged for the amount of your first payment (25% of the total cost) upfront. Then, two weeks later, you’ll need to make your second payment. This will happen three times until your payments have been made in full. To keep you on track, the app will send you reminders to make sure you don’t forget your payment dates. You can even set up auto payments so that you never miss a payment!

What are the advantages of using Afterpay?

Here’s a quick breakdown of the advantages of this convenient digital service:

- Buy now, pay later

- It’s free as long as you make your payments on time

- Never pay interest on your purchases

- Skip the hassle of applying for a credit card

- Download and use regardless of your credit score

- Add it to your existing digital wallet

By far the biggest advantage of using Afterpay is the fact that it allows you to buy what you want now and pay for it over time later. Similar to the way a credit card works, Afterpay allows shoppers to access the things they want and need without having to fork over the full cost upfront.

Unlike a credit card, though, Afterpay does not require credit checks or applications from its users. And what’s even better? The service never charges interest. That’s right. The only time you’ll ever get charged a fee is if you miss a payment deadline. So, if you know you’re good with your money and you feel confident that you can pay on time every two weeks, Afterpay is a great alternative to a credit card, at least for daily purchases and smaller investments.

This is NOT accurate as of 09/10/2022 @ 1328. You CANNOT pay with Afterpay.