If you’ve ever shopped on Walmart.com, then you might have noticed a mysterious “merchandising fee” appear on some of your transactions. Depending on what you purchase and how much the item costs, this fee amount can vary quite a bit.

So, what exactly is a merchandise fee and why are you being charged for it?

We weren’t exactly sure either, so we turned to a few of the experts for answers.

According to Repsly.com, “the merchandise processing fee is the U.S. Customs and Border Protection charge associated with most imports entering the United States.”

In other words, a merchandising fee covers the border and customs fees merchandisers will have to pay to ship your item to wherever you live. If you live in the same country where the item you’re purchasing is produced, then you probably won’t see a merchandising fee appear on your transaction.

In some cases, merchandising fees might cover other miscellaneous costs associated with the vendor getting the products to the consumer (you).

According to Zippia.com the Walmart merchandising fee is capped at $25 for orders under $2,500.

When Do You Pay Merchandising Fees?

First of all, it’s important to note that Walmart customers never pay merchandising fees when shopping in person at Walmart retail locations.

These merchandising fees will only appear when you’re shopping on Walmart.com and purchasing something that a) is being sold by a third-party vendor and b) needs to be imported from another country or has some other associated fee for transferring the product to the consumer.

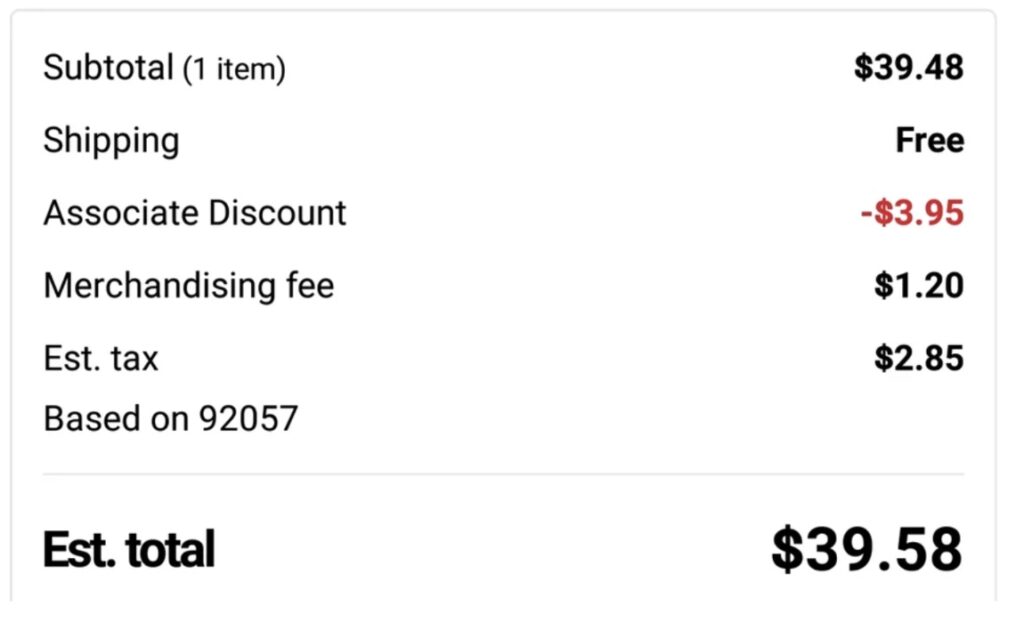

Here is an example of how you might see your merchandising fee appear on your transaction page (this comes from a transaction made by a Walmart employee, hence the associate discount):

In this example, the $1.20 fee accounted for the $0.05 per can CRV charge California requires for all canned beverages (the shopper was purchasing a container of Monster energy drinks).

So, as you can see, the merchandising fee is not always associated with import costs.

FAQs

Do other stores also charge merchandising fees?

Yes. Many online retailers who supply products from overseas also charge merchandising fees. In fact, this is required for vendors who engage in international shipping and sales from multiple vendors.

Who manages the amount of the merchandising fees?

Merchandising fees are determined by national customs offices based on categories of goods. The vendor is responsible for managing the merchandising fees with the customer so that the appropriate amount can be paid to customs during shipping.

Is Walmart’s cashier surcharge different from merchandising fee?

Yes. Merchandising fees only apply to purchases made through Walmart.com from third-party retailers.

Conclusion

The Walmart merchandising fee is a fee that covers miscellaneous costs associated with getting products to customers. Most often, the merchandising fee covers the cost of importing an item from a third-party retailer overseas and is determined by The U.S. Customs office.

Merchandising fees are only applicable online when shopping from third-party vendors and cannot be opted out of. Even if you shop from somewhere other than Walmart, you’re likely still going to pay merchandising fees if you’re buying products from overseas.